When it comes to workplace safety for a sawmill, a single overlooked detail can have unfortunate consequences. For ill-prepared businesses, surprise OSHA inspections can also be damaging, from fines to operational shutdowns. Injuries, fines, or shutdowns are not just frustrating; they can be costly and make it harder to acquire or maintain necessary insurance coverage. Maintaining a safe work environment takes precision, vigilance, and a comprehensive approach to risk management through adequate insurance coverage.

We’ve compiled the following guidelines surrounding OSHA requirements for sawmills, how compliance impacts insurance premiums, and immediate steps owners and operators can take to protect their crew, equipment, and bottom line.

Why OSHA Compliance is Imperative for Sawmill Operations

For sawmills, OSHA compliance is one of the best ways to reduce injuries and control insurance costs. Common sawmill non-compliance issues include:

- Missing machine guards

- No lockout/tagout process

- Dust accumulation and fire risk

- Unprotected noise levels

For insurance providers, these violations raise red flags, suggesting a lack of oversight that makes it harder to underwrite the operation. On the other hand, a safe, documented program demonstrates a commitment to managing risks, which can help lower insurance rates.

Important OSHA Requirements for Sawmills

Some of the primary areas OSHA inspectors focus on include:

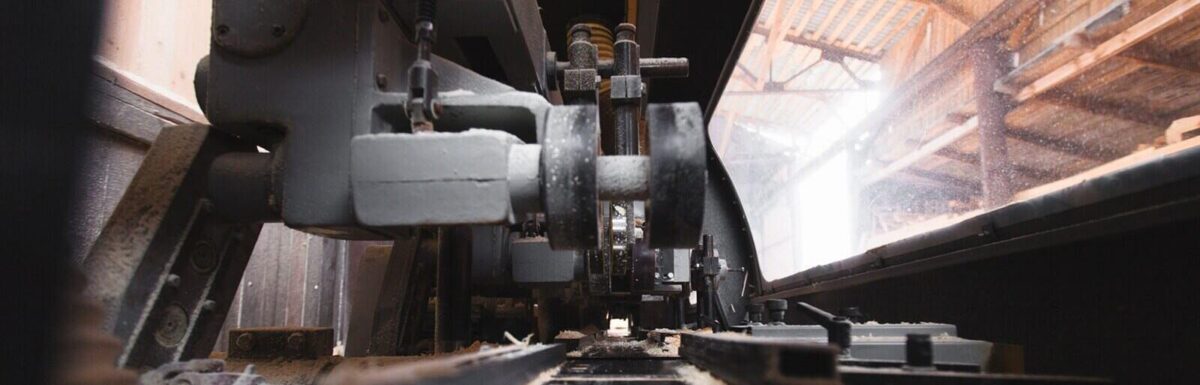

Machine Guarding (29 CFR 1910.265)

All moving parts, such as saws, belts, pulleys, and chains, need physical guards to prevent accidental contact.

Lockout/Tagout Procedures

Before servicing equipment, workers must isolate it from power and clearly tag it to prevent others from turning it on.

Noise Protection

Sawmills often exceed safe noise levels. If the average noise is 85 decibels or more, OSHA requires hearing conservation programs.

Dust Control and Fire Prevention

Wood dust is highly combustible and requires regular cleaning, proper ventilation, and accessible fire exits.

Fall Protection

Elevated platforms, ladders, and catwalks should have guardrails, safety nets, or personal fall arrest systems, such as harnesses.

Emergency Planning and PPE

Every site must have a written emergency action plan and stock the proper personal protective equipment (PPE) for each task.

For additional sawmill safety rules, visit OSHA’s sawmill safety page.

How OSHA Compliance Impacts Sawmill Insurance Coverage

When a business applies for insurance, the insurer evaluates its risk level. One of the first areas the insurer examines is the safety record of the business. Multiple OSHA violations or a history of workplace injuries indicate a high likelihood of expensive claims. This assessment results in higher premiums or fewer insurance options for the risk-prone business.

Conversely, a clean OSHA record and well-documented safety practices help sawmill operators:

- Avoid premium increases

- Access better coverage options

- Get faster claim approvals with fewer questions

- Qualify for broader insurance policies with fewer exclusions

Sawmills that have taken the time to build a safety program that meets or exceeds OSHA’s requirements stand the greatest chance of getting the best coverage at the lowest price.

Common Insurance Coverages Sawmill Operations Need

Operating a sawmill has built-in risks and requires the right insurance coverage. Here are the core insurance policies most sawmill operators should consider:

General Liability Insurance

This policy covers injuries to visitors to the sawmill or damage to their property. For example, if a visitor trips over equipment at the mill or a customer claims a defective product caused them harm, general liability insurance helps cover the legal costs and settlements.

Commercial Property Insurance

The buildings, machinery, and inventory are all essential to the operations of a sawmill. Property insurance protects those physical assets from fire, theft, storm damage, and other unexpected incidents. This is especially important for mills that store lumber, operate kilns, or house expensive equipment on-site.

Workers’ Compensation

Virginia requires most employers to carry workers’ compensation insurance. This covers medical expenses and lost wages if an employee gets injured on the job. In sawmills and other high-risk settings where the chance of injury is higher than average, workers’ comp is not just a requirement but a wise investment to protect the business and its people.

Commercial Auto

Many mills transport logs, lumber, or finished products. If a mill uses trucks or other vehicles, commercial auto insurance is necessary to cover accidents, damage to other vehicles, and injuries involving company vehicles.

Equipment Breakdown Coverage

Machinery such as saws, planers, and loaders can break down unexpectedly. This coverage helps pay for repairs or replacements and may even cover lost income while the equipment is offline.

Umbrella or Excess Liability

When a claim against the sawmill exceeds its general liability insurance limits, umbrella or excess liability insurance will cover the rest. This type of insurance coverage is a beneficial choice for sawmills, especially those that work with large contracts or operate in areas with high litigation risk.

The Importance of Working with the Right Insurance Partner

Operating a sawmill requires more than just sharp equipment and a skilled crew. It takes the right partners, especially when it comes to risk and insurance.

An insurance agent who understands the lumber and wood-products industry does more than sell policies. They help anticipate the risks unique to sawmills and align coverage with safety practices.

The right insurance advisor helps close gaps in coverage, manage costs, and support safety goals.

Contact Burton & Company to Get OSHA-Ready and Fully Covered Before the Next Inspection

From managing tight margins, strict regulations, and nonstop safety concerns, operating a sawmill can be challenging. However, staying OSHA-compliant can make your operation more safe, efficient, and appealing to insurers.

The right insurance partner helps you connect the dots between safety and coverage. At Burton & Company, we do not just quote policies; we work with sawmill operators across Virginia to build solid plans that reduce risk and help protect your people, equipment, and livelihood. Contact Burton & Company today to protect your operation and mitigate risks.